Found the perfect home. Signed the contract. Now What?

Knowing what to expect and clear communication is key to a successful closing. The first step for the buyer is to secure financing if it is required. This means submit your application and all of the requested financial information to the bank as quickly as you can. You should receive your loan estimate, which estimates your actual closing costs, within three days of submitting your application. While your loan is being reviewed, the bank will need to contact the title company, the appraiser and the survey company if a survey is required. Sometimes the bank does not make immediate contact and it is important for you to follow up to make sure this is done so it doesn’t hold up your closing. It can take upwards of 3 weeks to get an appraisal in some instances. It can take 2 weeks to get a survey. It generally takes a week to get the title commitment to find out if there are any title problems associated with the property. At this point, the title company will work to clear up all the title problems that can be resolved. About a week prior to the closing date, your title agent should contact you to set up the closing place and time. If this is going to be a mail-out closing, make sure you let them know this. Three days prior to your scheduled closing date you will receive the Closing Disclosure from your bank. The Closing Disclosure provides the final loan terms and closing cost details; carefully review this document to be sure the details are correct. If something looks different than expected from the initial Loan Estimate, you should contact your lender. When the closing agent is satisfied that everything is in order and all the instructions are prepared and distributed, it’s time for the closing.

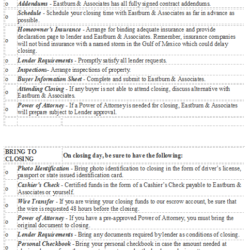

What to bring to closing?

- Payment. Certified or cashier’s check is acceptable at the closing. However, if you are planning on wiring funds that will need to be done the day before. Do not bring personal checks or cash.

- Proof of insurance. Your lender requires you to buy a homeowner’s, also called hazard, insurance policy. You will need to bring proof that you have the insurance in effect on closing day and a receipt showing you’ve paid the policy for a year.

- Photo ID. The escrow agent needs to confirm who you say you are. A driver’s license or current passport will do.

- Contract. Bring the sales contract in case you need to check a detail against closing costs or mortgage terms.